Moving to the United Kingdom brings exciting opportunities, but navigating the UK banking system can feel overwhelming for newcomers. Whether you're here on a work visa, family visa, or have recently obtained settled status, understanding how to make your savings work for you is crucial. UK savings accounts offer a secure way to grow your money while you build your life in Britain. This guide explores how immigrants can maximise their savings through strategic account selection and comparison.

Why UK Savings Accounts Matter for Immigrants

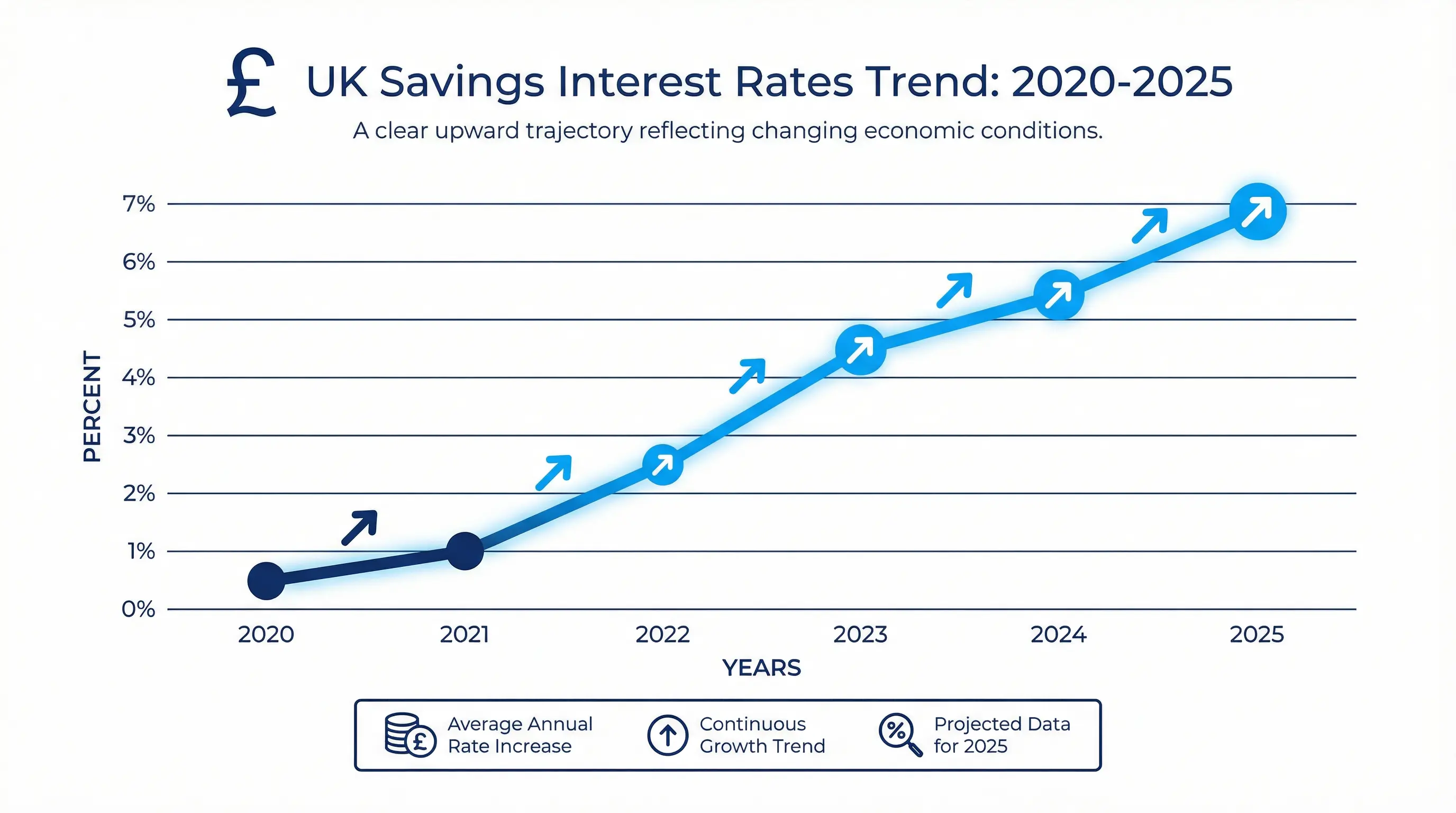

After years of historically low interest rates, the UK savings market has experienced a significant transformation. Many new residents arrive with savings that were previously earning minimal returns in their home countries. The current UK market offers compelling opportunities: More than 68% of financially active immigrants who actively manage their finances now utilise specialised savings products, while only around 22% rely solely on basic current accounts. This trend demonstrates a growing awareness among newcomers about optimising their financial position in the UK.

The Art of Optimal Savings Strategy

Successful savers distinguish themselves through strategic thinking. They understand that passive behaviour often leads to missed opportunities. Instead, they regularly analyse the market, evaluate new offers, and adjust their strategy accordingly. This discipline pays off: those who continuously seek the best conditions and adapt their portfolio can achieve significantly higher returns than those who leave their money unchanged in a single account for years.

Three Pillars of Successful Savings Strategy:

1. Continuous Market Monitoring: Financial markets evolve dynamically. Those who regularly check current offers and observe market changes can respond promptly to new opportunities and optimise their portfolio.

2. Diversification Across Multiple Institutions: Savvy savers strategically distribute larger sums across different banks. This not only optimises protection through FSCS coverage but also provides access to varying interest rates and conditions.

3. Balance Between Flexibility and Returns: The optimal strategy combines flexible easy-access accounts for short-term availability with fixed-rate products for higher interest rates. This mix offers both security and attractive returns.

Current Market Analysis: Where We Stand Today

The current UK savings market presents positive opportunities for savers. After a prolonged period of low interest rates, conditions have improved significantly. Leading easy-access providers can offer example rates of up to 5.2% (no guarantee, rates may change at any time), representing a substantial increase compared to previous years. For fixed-rate products with a twelve-month term, example rates of up to 6.8% are possible (no guarantee, may change). This development reflects the changed monetary policy landscape and can offer interesting perspectives for your savings. Please note that all mentioned interest rates are examples and may change at any time.

Case Study: How Priya M. from London Optimised Her Finances

⚠️ Important Notice: The following case study is a fictional example for illustration purposes only. It does not represent a real person or actual experience. All mentioned figures, names, and details are examples and serve only for illustration. No guarantees for similar results.

"When I moved to the UK three years ago on a skilled worker visa, I arrived with £35,000 in savings that were sitting in a basic current account earning virtually no interest. As an immigrant, I was initially focused on settling in and finding my feet, but a colleague mentioned how they were earning interest on their savings, which sparked my interest."

"After thorough research, I discovered there were significantly better options available. I opened two easy-access savings accounts with rates of 4.8% and 5.1%, and also placed a portion of my savings in a fixed-rate product offering 6.2% interest. Spreading my money across multiple banks gave me additional security through FSCS protection."

"Three years later, through this strategy and regular monitoring for better offers, my original capital has grown to over £42,000. The key for me was staying active and not simply leaving everything in one account. As someone new to the UK banking system, I found that many providers welcome immigrants and make the application process straightforward."

Important Disclaimer: This is a fictional example for illustration. It does not represent a real person or actual experience. All mentioned figures, names, interest rates, and results are examples and serve exclusively for illustration purposes. No guarantees for similar results. Results vary depending on individual circumstances, interest rates, and market conditions. Past performance does not guarantee future results. This is advertising content and not financial advice.

UK Savings Accounts in Detail: What Options Do You Have?

The UK savings market offers various product types that meet different needs. Each variant has specific advantages and considerations to understand:

- Easy Access Savings Accounts: These offer maximum flexibility – you can access your money at any time while still earning interest. Example top offers can be around 5.2% p.a. (no guarantee, rates may change) and are ideal for emergency reserves or short-term savings.

- Fixed-Rate Savings: For higher interest rates, you commit your capital for a fixed period (usually between 3 months and 5 years). Example top providers can offer up to 6.8% for twelve-month terms (no guarantee, may change) – ideal for money you don't need short-term.

- FSCS Protection: All UK savings accounts enjoy protection up to £85,000 per person and bank through the Financial Services Compensation Scheme. This provides a high level of security for your savings.

- Transparency and Costs: Modern UK savings accounts feature clear terms. Most providers avoid hidden fees and enable fully digital account management.

- Easy Management: Most accounts can be opened and managed completely online. Modern banking apps provide convenient oversight of all your savings.

The Path to Optimal Savings Accounts

Choosing the right savings account can be challenging when you consider that more than 200 different banks and financial service providers in the UK offer corresponding products. Each provider has different conditions, interest rates, and requirements. Without systematic comparison, it's nearly impossible to find the best offer for you.

Modern comparison platforms make this task significantly easier. They offer:

- Current market overviews with daily-updated interest rates from various providers

- Detailed comparison tables that clearly present all important conditions

- Intelligent filter functions for terms, minimum deposits, and special requirements

- Transparency about FSCS protection status of all listed offers

- Direct links to providers for quick application

💡 Strategic Tip:

For larger savings amounts, it's worth pursuing a multi-bank strategy. By spreading across different institutions, you can not only optimally utilise the £85,000 FSCS protection limit but also benefit from different interest rates. Some providers offer particularly attractive conditions for new customers, while others may offer long-term stable interest rates (no guarantee, rates may change).

Compare UK Savings Accounts Now

Discover the best savings account offers from over 200 UK financial institutions in just a few minutes. Our comparison service is completely free, non-binding, and helps you find the right product for your individual needs as a new UK resident.

⚠️ Affiliate Link: The following link is an affiliate link. If you use a service through this link, we may receive compensation. This does not affect the prices or conditions you receive.

Compare Interest Rates Now✓ Example top interest rates up to 5.2% on easy access (no guarantee)

✓ Full FSCS protection up to £85,000

✓ Free and non-binding comparison

⚠️ Important Information About This Advertising Content:

This is paid advertising. The information provided here is for informational purposes only and does not constitute financial advice. All information regarding interest rates and conditions is provided without guarantee and may change without notice.

Risk Information: Even with FSCS protection, it's important to thoroughly research before making financial decisions. Past performance does not guarantee future results. Please note that interest earnings are subject to UK taxation.

No Guarantees: We provide no guarantees regarding returns, earnings, or financial results. This is merely informative advertising. Results vary between individuals, and there's no certainty that similar results can be achieved. We make no promises regarding financial results.

No Financial Advice: This content does not constitute financial, investment, or legal advice. We are not authorised or regulated by the Financial Conduct Authority (FCA) and do not offer regulated financial services. Always seek advice from an independent financial adviser or contact financial institutions directly before making decisions.

Interest Rate Information: All mentioned interest rates (5.2%, 6.8%, and others) are exclusively example figures for illustration and may not be available to all applicants. Interest rates can change at any time and vary depending on individual circumstances, market conditions, and providers. Always verify current interest rates directly with providers. We provide no guarantees regarding the availability or amount of mentioned interest rates.

Affiliate Relationships: This website contains affiliate links to partner services. If you access a service through these links and complete an action, we may receive compensation. This does not affect the prices or conditions you receive. All affiliate links are clearly marked.

Frequently Asked Questions

How does FSCS protection work for savings accounts?

In the UK, all savings accounts are protected by the Financial Services Compensation Scheme (FSCS). This means your deposits are protected up to £85,000 per person and banking institution. Some providers also offer additional voluntary protection schemes that can cover higher amounts.

Are there minimum deposit requirements for savings accounts?

Requirements vary by provider and product. While many easy-access accounts can be opened with small amounts, fixed-rate products often have higher minimum deposits. Comparison portals show you transparently what requirements different providers have.

What's the difference between easy access and fixed-rate savings?

Easy access accounts offer maximum flexibility – you can access your money at any time while still earning interest. Fixed-rate savings commit your capital for a fixed period but typically offer higher interest rates. The choice depends on your individual needs and savings strategy.

How are interest earnings taxed in the UK?

Interest earnings in the UK are subject to income tax. Banks typically deduct tax automatically through the Personal Savings Allowance. Depending on your personal tax situation, you may benefit from allowances or claim tax relief. For individual tax questions, you should consult a tax adviser or HMRC.